A Future Dilemma: Renewables, Electric Vehicles and Tax

With the eventual increased electric vehicle (EV) uptake and increased solar off-grid solutions in South Africa there may be several issues that need to be accounted for. First, is the problem of slow uptake and the likely strategies that can be implemented to drive this. Driving uptake will then leads us to the second and third issue. Namely, the impact on the current internal combustion engine (ICE) value chain which ranges from manufacturing to servicing and eventually end of life disposal. Then thirdly, and very importantly, will be the implications on government revenue from the current fuel levy that will decrease significantly when there is lower demand for fuel. It is very likely that to compensate for this they will institute a tax on solar generation capacity. This paper will briefly discuss these issues and the broader implications.

EV Strategies and Inequality

South Africa cannot be compared directly to other countries that have adopted EV strategies to push the uptake. The two sectors that need to be included in such an analysis are passenger transport and logistics. Under passenger transport, public and private sector entities play a significant, but separate role, in the potential uptake of EVs. Under the logistics industry, more traditional market factors are at play and there is more potential for adopting strategies that have been used in other major economies. South Africa’s economic structure and demographic profile is unique with significant disparity in wealth. This will have direct implications on how government and the private sector can drive the uptake of EVs. Strategies that have been implemented in developed economies may not be relevant in the South African context. When it comes to EV strategy there has been success in the European model of incentivising uptake through city-level initiatives that directly impact the consumer. These are usually the most effective as they hit the pocket of the consumer who drives the most, and there is a direct use-to-cost reward or penalty involved. Incentives or penalties that are implemented on a national scale do not have such an immediate impact as they span across a number of sectors and are implemented on the public that may not drive frequently in an urban environment. For instance, implementing a broad incentive to reduce licencing costs of EV vehicles compared to ICE vehicles will not be as effective as implementing an incentive or penalty that directly correlates to the number of kilometres driven in a specific area.

The South African conundrum comes into play as people from different economic classes share the same roads. Imposing a blanket penalty on kilometres driven in, or to, a city centre will have a significantly greater negative impact on the poor than those with higher income. The ability of a lower income individual to shift to purchasing an EV will not be as simple. In South Africa the majority of lower-income individuals use transport services. The major difference between South Africa and other countries is that our ‘public’ transport services are not entirely ‘public’. It is dominated by the taxi industry which is not governed by local city budgets. Pure public transport may shift to EV technology but moving the taxi industry to EVs will require substantial buy-in from the associations and may not be feasible with the need for significant charging infrastructure that will require maintenance.

The clear takeaway from this is that South Africa will have to utilise a combination of private and public incentives or penalties to ensure uptake of EVs. Simply placing a mandate on eliminating ICE vehicles from inner-city roads by a certain date will not be feasible as it is in Europe. Penalties on ICE vehicles may also place an unnecessary burden on lower-income individuals and place strain on economic activity. But how should South Africa drive these initiatives? It will be important to focus on the logistics industry and public transport initiatives. The last mile delivery sector has significant potential for minimising carbon output and shifting to renewable EV solutions. Similarly, cities can adapt their public transport systems and convert them to EV fleets. The shift from ICE to EV in private transport and in the taxi industry would then be a natural process as EVs become more affordable and charging infrastructure more accessible. The total cost of ownership of an EV compared to a standard ICE vehicle has changed significantly in developed economies. Using Europe for example we see that smaller EVs in Europe have a considerable advantage over ICE for average commuters doing approximately 50 to 100 kilometres per day. The high cost of fuel in Europe, combined with the relatively good resale value of EVs and incentives gives the advantage. With higher electricity costs in Europe compared to Asia and the US, lighter EVs with smaller battery capacities also have the advantage in terms of total cost of ownership over larger EVs.

In South Africa one of the most important factors in EV uptake by the private sector will be the fuel price. This will play a dominant role in a country like South Africa. As EVs become more affordable people will see the benefits of shifting if it makes economic sense. The issue here is that with declines in demand for ICE globally and with reduced fuel consumption, there should naturally be a decline in the oil prices. This is where government could potentially run into the EV and fuel tax conundrum. Before we discuss this, it is worth noting that pushing EV uptake will speed up the timelines to disruption in the current ICE production and servicing value chains. There will be definite economic implications and the speed of strengthening new linkages in local EV production value chain become crucial. Ultimately, there will be a choice. To push or not to push.

The ICE Value Chain and Shift to EV

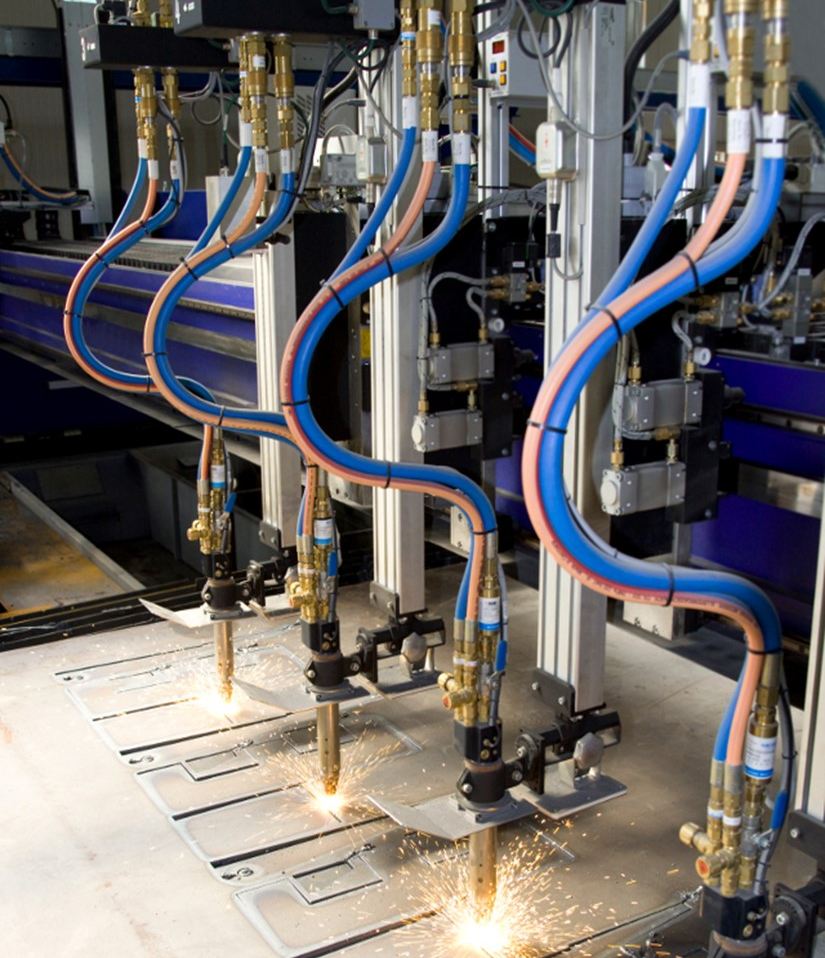

In the ICE drivetrain there are approximately just over 2,000 moving parts, whereas in an EV drivetrain there are only 20. The moving parts of the EV are also mostly manufactured in-house with relatively fewer outside suppliers in the value chain. There are also differences on the wear-and-tear replacement aspect of these vehicles. According to an estimate done by Volkswagen a traditional ICE vehicle has approximately 4,000 parts, with an EV just under 3,000. Hybrid vehicles, with both EV and ICE components are estimated to have just over 4,500 parts. Although these numbers are not vastly different, it must be noted that 70% of the EVs parts are entirely different components to that of an ICE vehicle. That would mean a 70-80% disruption of the traditional ICE automotive part value chain. Servicing needs for EVs are also different, with no requirement for regular service intervals that are needed for ICE vehicles with fluid and filter changes. With the advancement of self-diagnostic software in EVs, service intervals in the future may be determined by the vehicle itself, based on wear and driving conditions. The trend to EV will be gradual and will give time for traditional part manufacturers to shift to the production of the new parts, but to stay ahead of competition, they will therefore need to be manufacturing both ICE and EV components for a substantial amount of time to keep supply contracts with major OEMs. They will need to work with OEMs to plan and anticipate the timelines for decommissioning of the ICE drivetrains from their model line-up. But with this, they will need to keep supporting ICE vehicle part supplies till sufficient end-of-life periods.

There seems to be a significant drive from governments to align with the new EV and especially battery value chains. Many of these initiatives are the subject of ideas of taking advantage what natural resources a country might have. It must be noted, however that the manufacturing capability for battery technology is high specialised and proprietary. This places many of these initiatives at a disadvantage from the start. LG Chem's LG Energy Solutions in Poland have the largest battery manufacturing plant in Europe and supply to the majority of the European OEMs. Chinese company Contemporary Amperex Technology (CATL) has approximately 33% global battery market share, followed by LG at 22% and Panasonic at 15%. The market is dominated by larger players so any short-term wins that are to be made from establishing battery manufacturing plants have to be done under one of these larger companies. With the significant economies of scale in these production processes the plants are also most likely to be giga-factories that supply to a number of OEMs. The competition is high, and it will not be a simple process to establish such a plant in South Africa, just because we have resources for production.

The key differentiator will be future R&D and development of technologies with higher energy densities. For instance, solid state batteries are more efficient and will most likely become the future technology of choice when fully developed. Another key differentiator for EVs in the future will be the actual battery ownership business model. Currently the market is dominated by proprietary battery packs and technologies that are specific to the type of OEM and even the model of vehicle. An interesting concept that is being piloted and promoted in China is that of ‘open-source’, non-proprietary battery technologies and packs that can be swapped. This means that a vehicle can stop at a station and have the entire battery pack swapped and drive further with no need for charging. Obviously, there are advantages and disadvantages to this business model. The major downside is that the battery pack is the ‘heart’ of the EV. If you have an older pack that cannot handle the loads of high acceleration, then the performance of your vehicle will be impacted. This is particularly problematic and unacceptable with performance vehicles. But with cheaper EV solutions and vehicles, the mindset of ownership and performance may change if you are limited to a certain speed by traffic conditions.

The shift to EV will be relatively gradual in SA, but eventually in the future there will be more EVs on the road than traditional ICE vehicles. This will lead to an eventual decline in the demand for fuel and with it a decline in tax revenue from government.

Fuel and Renewable Tax

With the removal of the fuel levy the South African National Treasury estimates that there would be a R 90 billion loss to the fiscus. Currently the government is temporarily reducing the fuel levy to alleviate the pressure from rising oil prices due to the war in Ukraine, but eventually in the future the fuel tax revenue will be limited by the lack of demand. During the time of limited demand, the government can take advantage of the fact that lower oil prices could allow them to increase the fuel levy to accommodate lower volumes with higher prices. This is, however, not a sustainable scenario. Another, more controversial, scenario is that government may institute a ‘renewable generation’ tax that will target solar and wind generation by private individuals to power their homes and vehicles to replace the fuel levy. Many countries currently have renewable energy tax credits that incentivise the use of renewable energy. In South Africa this was accounted for as from 1 January 2016, where an amendment to Section 12B of the Income Tax Act (Act 58 of 1996) allows for depreciation in the year of commissioning of the full (100%) cost of a grid-tied solar PV system of less than 1 MW that is used for electricity generation by a business for use in its operations. Currently taxation related to renewables is mostly concerned with tax breaks and credits to drive uptake. But once renewable generation becomes the norm and carbon cannot be taxed effectively, it can become very likely that renewable generation will be taxed. In terms of revenues associated with the fuel levy, either alternatives, such as mandatory public driver’s insurance, or other tax collection will have to be implemented to account for the current revenue loss. Alternatively, the taxation of charging a vehicle may become an option, similar to that of a fuel levy.

The conundrum that government will have to face is choosing when to drop and when to push the fuel levy as this will have a major impact on adoption of EVs. If the fuel levy is maintained and increased to account for lower oil prices, it will keep the price of fuel high and thus lower the relative total cost of ownership of EVs. If it is dropped, the adoption of EVs may be slower due to a smaller difference or even a higher total cost of ownership of EVs under certain driving conditions. If, however, the country were to push adoption of EV and renewable generation, the revenue generated from the fuel levy will eventually dry up and leave a serious gap in the fiscus. The eventual gap will have to be planned and accounted for, either using private sector intervention to provide the services from the estimated R90 billion currently provided by the public sector or find alternative means of collecting the revenue for the public coffers. Possibly, very likely from renewable energy production. Nothing is impossible and has very likely already been discussed as an option.

To find out more about opportunities in Africa, please contact Lynne Martin.

Lynne Martin

Rebecca Mabika