Seeds of Opportunity: The African Growth Series

July 2025

In this month's issue, you will learn more about:

- AFRICA OPPORTUNITY: Expanding African Rail with the Lobito Corridor

- AFRICA OPPORTUNITY: Wind Energy as a Catalyst for Africa’s Just Energy Transition

- AFRICA OPPORTUNITY: Renewable Energy Powers Africa’s SEZs

- AFRICA OPPORTUNITY: Nigeria’s Agro-Industrial Boom

- AFRICA OPPORTUNITY: Building Innovative Infrastructure for South Africa’s Growing Economic Landscape

- AFRICA OPPORTUNITY: Coal-to-Fertilisers as an Industrial Growth Strategy

- UPCOMING EVENT: Manufacturing Indaba 2025

AFRICA OPPORTUNITY: Expanding African Rail with the Lobito Corridor

The $1.6 billion Lobito Corridor is one of the most ambitious transport infrastructure projects currently underway in Africa. Connecting Angola’s Atlantic coast to the heart of the continent, the upgraded 1,300 km rail line will link the port city of Lobito to the DRC and Zambia via key mineral and trade hubs.

Led by the Lobito Atlantic Railway consortium, comprising Trafigura, Vecturis, and Mota-Engil, this public-private partnership represents a new model for strategic infrastructure investment. Backed by development finance institutions from the US, the EU, and the African Development Bank, the project is designed to enhance mineral exports and to facilitate agricultural trade with reduced transportation costs across the region.

The DRC is expected to benefit significantly, with a shorter, more reliable export route for copper and cobalt. Zambia also sees new incentives for regional logistics integration. For Angola, the project promises economic revitalisation in its interior provinces through job creation, supporting industries, and better market access.

As Africa deepens its cross-border industrial and trade capacity, the Lobito Corridor is a powerful case study in how coordinated infrastructure investment can drive long-term competitiveness. Could the Lobito model be a blueprint for scaling Africa’s intra-regional logistics capacity?

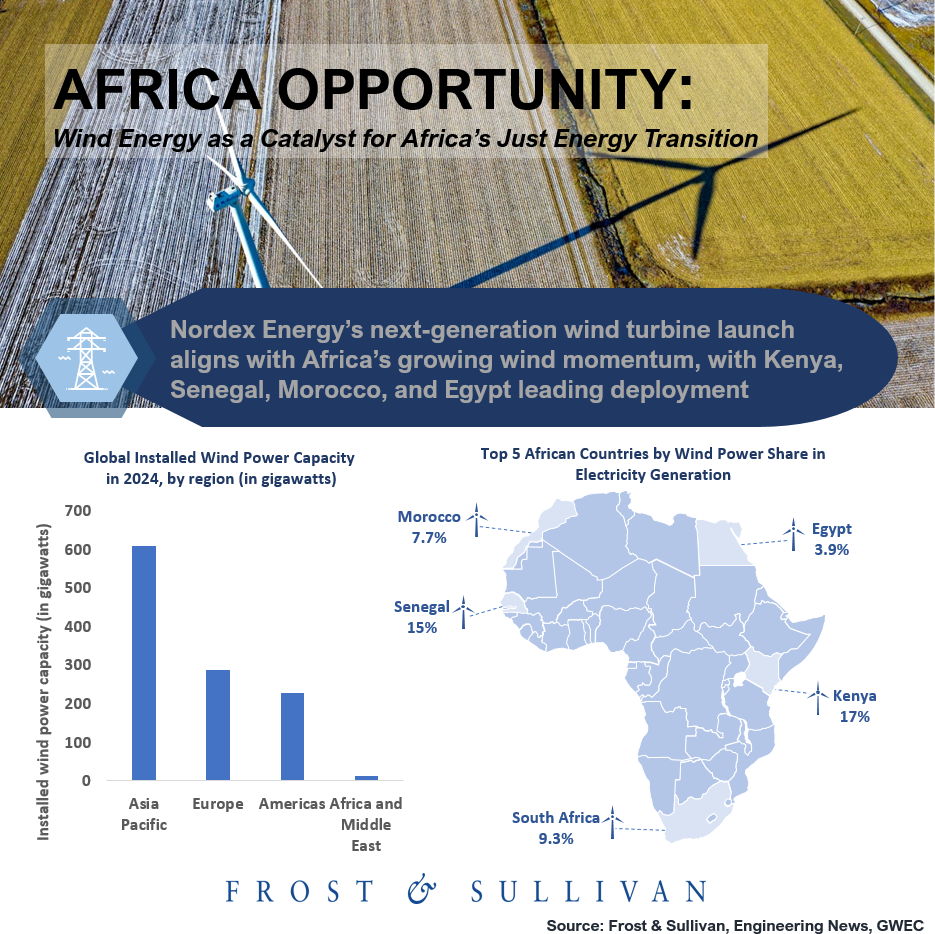

AFRICA OPPORTUNITY: Wind Energy as a Catalyst for Africa’s Just Energy Transition

Africa holds an estimated 180,000 terawatt-hours of annual wind energy potential, which is enough to meet the continent’s electricity demand 250 times over. Yet despite this, wind power remains underutilised across most African markets. The continent’s leading countries have made notable progress, with wind contributing 17% of total electricity generation in Kenya, 15% in Senegal, 9.3% in South Africa, 7.7% in Morocco, and 3.9% in Egypt. This underlines the momentum and the margin for growth in Africa, especially given the progress made in other regions globally.

Nordex Energy South Africa’s launch of its most powerful onshore wind turbine to date, the N175/6.X, underscores how global innovation is beginning to align with Africa’s unique energy needs. Purpose-built for low-to-medium wind conditions, including inland regions such as Mpumalanga, the turbine’s hybrid concrete-steel tower increases energy capture, stabilises grid performance, and supports more flexible deployment across the continent.

Equally important is the localisation model. By manufacturing components in South Africa, the project strengthens local supply chains and builds long-term industrial capacity, which are key pillars of a Just Energy Transition.

As global technologies evolve, Africa has an opportunity to deploy more wind power and shape an energy future that is local, inclusive, and resilient. Do you see wind power becoming a core part of Africa’s energy mix?

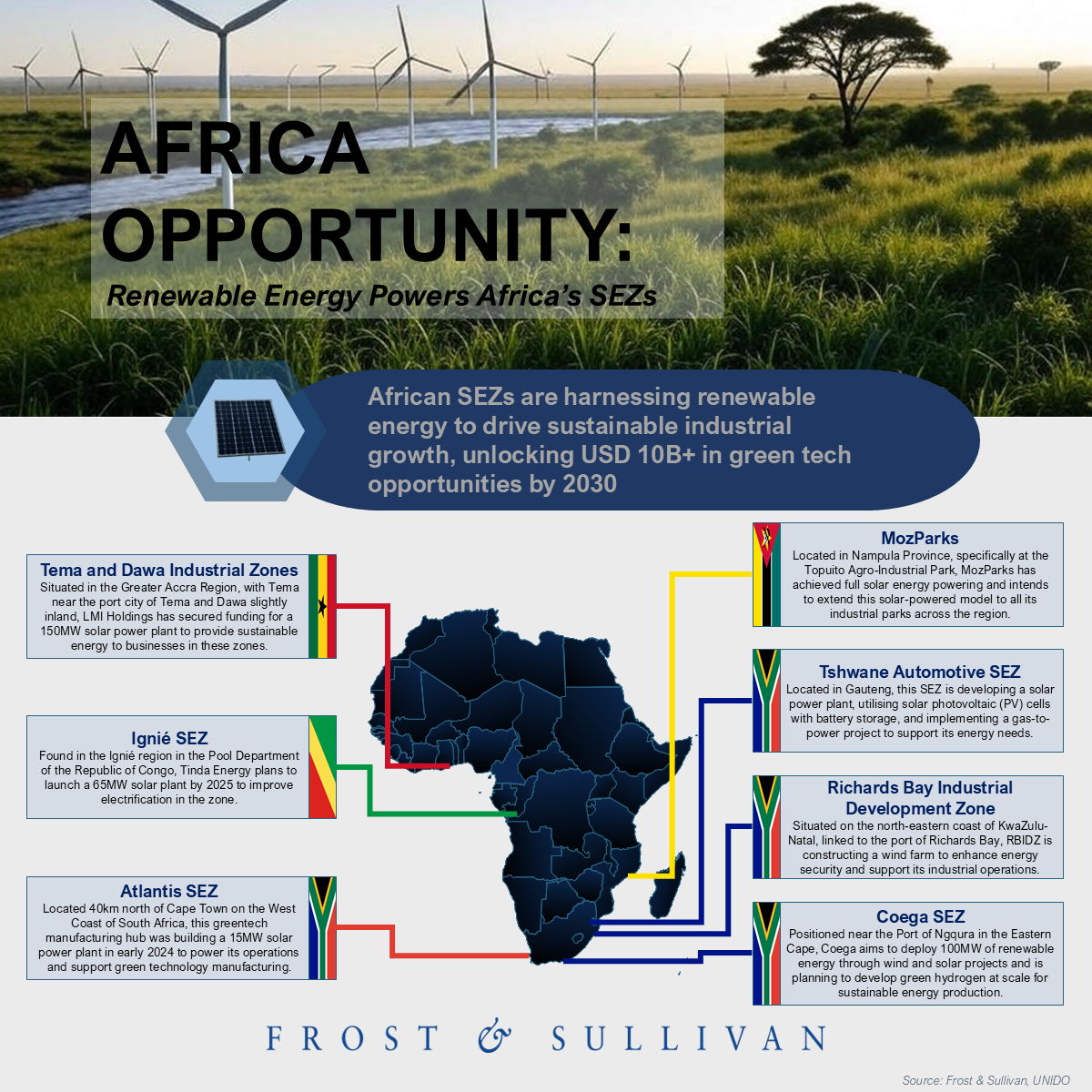

AFRICA OPPORTUNITY: Renewable Energy Powers Africa’s SEZs

Africa’s Special Economic Zones (SEZs) are at the forefront of a renewable energy revolution, driving sustainable industrial growth. The 2024 UNIDO-AEZO survey reveals 40% of African SEZs prioritise renewable energy, aligning with SDG 7. With renewable energy comprising just 6% of SEZ power versus 30% globally, the growth potential is immense.

In South Africa, Tshwane Automotive Special Economic Zone’s solar and gas projects, RBIDZ’s wind farm, and Atlantis Special Economic Zone’s 15MW solar plant showcase innovation. In Ghana, LMI Holdings’ 150MW solar plant powers industrial zones, while Mozambique’s MozParks runs entirely on solar. These initiatives signal a USD 10B+ investment opportunity in green tech by 2030.

Despite challenges like grid constraints and high costs, SEZs offer investors a chance to shape a sustainable future. Want to explore these opportunities? Contact Lynne Martin at lynne.martin@frost.com.

What’s your take on renewable energy’s role in Africa’s industrial growth?

AFRICA OPPORTUNITY: Nigeria’s Agro-Industrial Boom

Nigeria’s Special Agro-Industrial Processing Zones (SAPZs) are reshaping the agricultural landscape. With USD 2.2B from the African Development Bank and USD 538M in Phase 1 investments across eight states, SAPZs aim to slash Nigeria’s USD 4.7B food import bill. Kaduna and Cross River lead, targeting 60% productivity gains in maize, cocoa, and more.

Backed by ARISE IIP and Dr. Akinwumi Adesina, these zones will create 60,000+ jobs per state, boosting rural economies. Strategic hubs near universities like Ahmadu Bello University ensure innovation drives growth.

What’s your take on Nigeria’s agricultural transformation?

AFRICA OPPORTUNITY: Building Innovative Infrastructure for South Africa’s Growing Economic Landscape

South Africa’s innovation ecosystem takes another bold step forward with the launch of Enterprise Building 3 (EB3), a public-private partnership (PPP) between The Innovation Hub and Redefine Properties.

The R83.1-million investment supports the Gauteng Department of Economic Development’s broader goal of fostering knowledge-driven enterprises across sectors like ICT, the green economy, biotechnology, and advanced manufacturing. It forms part of a larger R2.5-billion infrastructure rollout aimed at fully realising the bulk development rights granted by the City of Tshwane to The Innovation Hub Management Company (TIHMC) for the science and technology park.

EB3 adds 10,000 m² of leasable space for startups, scale-ups, and research-driven firms, offering a fully serviced environment within Africa’s first accredited science and technology park. It also sets a precedent for how PPPs can fast-track innovation infrastructure and unlock shared economic value.

In an era where inclusive, innovation-led growth is more vital than ever, EB3 represents more than just a building; it’s a signal of confidence in South Africa’s entrepreneurial potential.

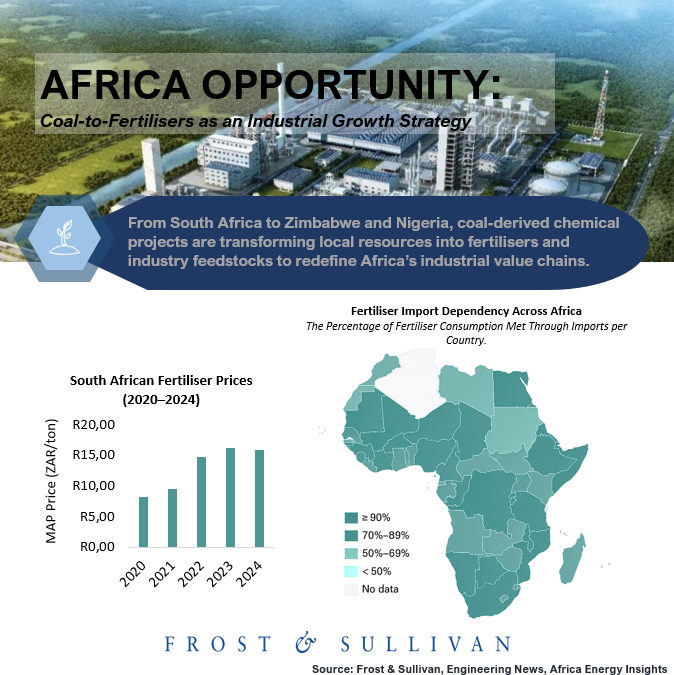

AFRICA OPPORTUNITY: Coal-to-Fertilisers as an Industrial Growth Strategy

South Africa’s HIRYO coal-to-fertiliser and methanol demonstration project signals a critical shift in how Africa can strengthen its agricultural base by localising fertiliser production.

This is especially urgent across a continent where over 80% of fertilisers are imported and price volatility continues to strain food systems.

In Zimbabwe, Verify Engineering is building a $750 million coal gasification plant to produce ammonia-based fertilisers, with the goal of raising national self-sufficiency from just 10%. In Nigeria, a major gas-to-methanol facility backed by the Africa Finance Corporation and Blackrose in Akwa Ibom will also add ammonia production in its second phase, supporting both fertiliser supply and industrial growth.

These efforts reflect a broader opportunity for Africa: to convert fossil fuel feedstocks not into outdated energy systems, but into the chemical foundations of agriculture and manufacturing. Beyond reducing import reliance, domestic fertiliser production can unlock new value chains, support job creation, and encourage the adoption of cleaner technologies such as carbon capture and lower-emission synthesis methods.

If more countries (such as Mozambique, Botswana, or Tanzania) prioritised fertiliser localisation through similar coal-to-chemical pathways, could Africa transform its agricultural resilience and industrial competitiveness simultaneously?

UPCOMING EVENT: Manufacturing Indaba 2025

Next week, join Africa’s leading manufacturers, policymakers, and innovators as we unpack the most critical trends, challenges, and opportunities shaping the future of African manufacturing.

Under the theme: “Igniting Africa’s Industrial Revolution: Innovation, Integration, and Inclusive Growth”, the conference will cover a dynamic range of high-impact topics.

- Africa – The Opportunity for Manufacturers & Regional Integration

- Resilient Manufacturing: Building Businesses That Thrive Through Disruptions

- Financing Africa’s Manufacturers: Unlocking Capital for Industrial Growth

- Sustainable Manufacturing & Green Energy

- Unlocking Africa’s Critical Minerals for Industrial Growth

- The Transformative Power of AI in Manufacturing Productivity

- Decarbonisation in the Automotive Industry

- Trade, Supply Chains & the AfCFTA

- Industry 4.0 & Smart Manufacturing

- Industrial Parks, SEZs & IDZs: Catalysts for Growth

- Agri-Industrial Development for Domestic & Export Markets

- Workforce & Skills Development for the Digital Era

- Public-Private Partnerships to Boost Industrialisation

- Emerging Manufacturing Frontiers in Africa

- Cybersecurity & Digital Risks in Manufacturing

Why Attend?

Book your spot today and be part of the continent’s premier manufacturing event.

Click REGISTER to attend the conference and be part of the discussions!

Exhibit your energy solutions at the Manufacturing Indaba Exhibition: https://manufacturingindaba.co.za/exhibitor-enquiry/

Visit: https://manufacturingindaba.co.za/ to learn more!

To find out more about opportunities in Africa, please get in touch with Lynne Martin.

Lynne Martin

Rebecca Mabika